Widow(er)’s Initial Minimum Amount (WIMA)

Why don’t I get a Cost-of-Living Adjustment?

Each year, in October, Social Security Administration (SSA) and Railroad Retirement Board (RRB) announce the cost-of-living adjustment (COLA) for the upcoming year. Each year, new widow(er)s question why they didn’t receive a COLA. They feel like they are getting shortchanged and ask why others are seeing COLA increases and they are getting nothing, and in some cases, because of increased Medicare premiums, actually see their take home amount go down.

The answer to these questions is found in the 2001 amendments to the Railroad Retirement Act (RRA) commonly referred to as, The Railroad Retirement and Survivors’ Improvement Act of 2001. When negotiating the changes to the RRA, rail labor and National Association of Retired and Veteran Railway Employees (NARVRE) agreed that an improvement to the survivors’ benefit was necessary. The next question was what funds were available to make changes to the survivors’ benefits and what changes could be made with the funds available.

The benefit that NARVRE most wanted to improve was the survivor benefits for the widow(er)s. Prior to 2001, the starting point for a widow(er)s annuity was 100% of the employee’s Tier I and 50% of the employee’s Tier II. Since Tier I already used 100% of the employee’s annuity as a starting point, the target was to improve the amount payable for Tier II. Ideally, the improvement would mirror the Tier I computation, and use 100% of the employee’s Tier II as the starting point for the survivors’ Tier II. Unfortunately, there were not sufficient funds to make this change and pay 100% of Tier II COLAs for the remainder of the widow(er)s life. So RRB’s chief actuary worked with the parties to find a solution within the available funds. The agreed upon solution is known as the Widow’s Initial Minimum Amount (WIMA).

The formula for computing the WIMA continues to use 100% of the employee’s Tier I as the starting point for the widow(er)s’ Tier I, but increased the starting point for the widow(er)s’ Tier II from 50% of the employee’s Tier II amount to 100%. However, because there were not sufficient funds to use this formula for computing the widow(er)’s Tier II, plus COLA, for the remainder of the widow(er)’s life, it was agreed that widow(er)s would give up COLAs until the WIMA equaled the amount the widow(er) was entitled to under previous law. While not an ideal solution, the WIMA did result in increasing the amount payable to widow(er)s upon their initial entitlement as a widow(er).

RRB states it this way,

Widow(er)s’ Benefits: The legislation established an “initial minimum amount” based on the two-tier annuity amount that would have been payable to the railroad employee at the time the widow(er)’s annuity is awarded, minus any applicable reductions. Widow(er)s’ annuities computed on the basis of the initial minimum amount will not increase until the amount payable under previous law plus cost-of-living increases is higher than the initial minimum amount. This provision was effective February 1, 2002, and was not retroactive.

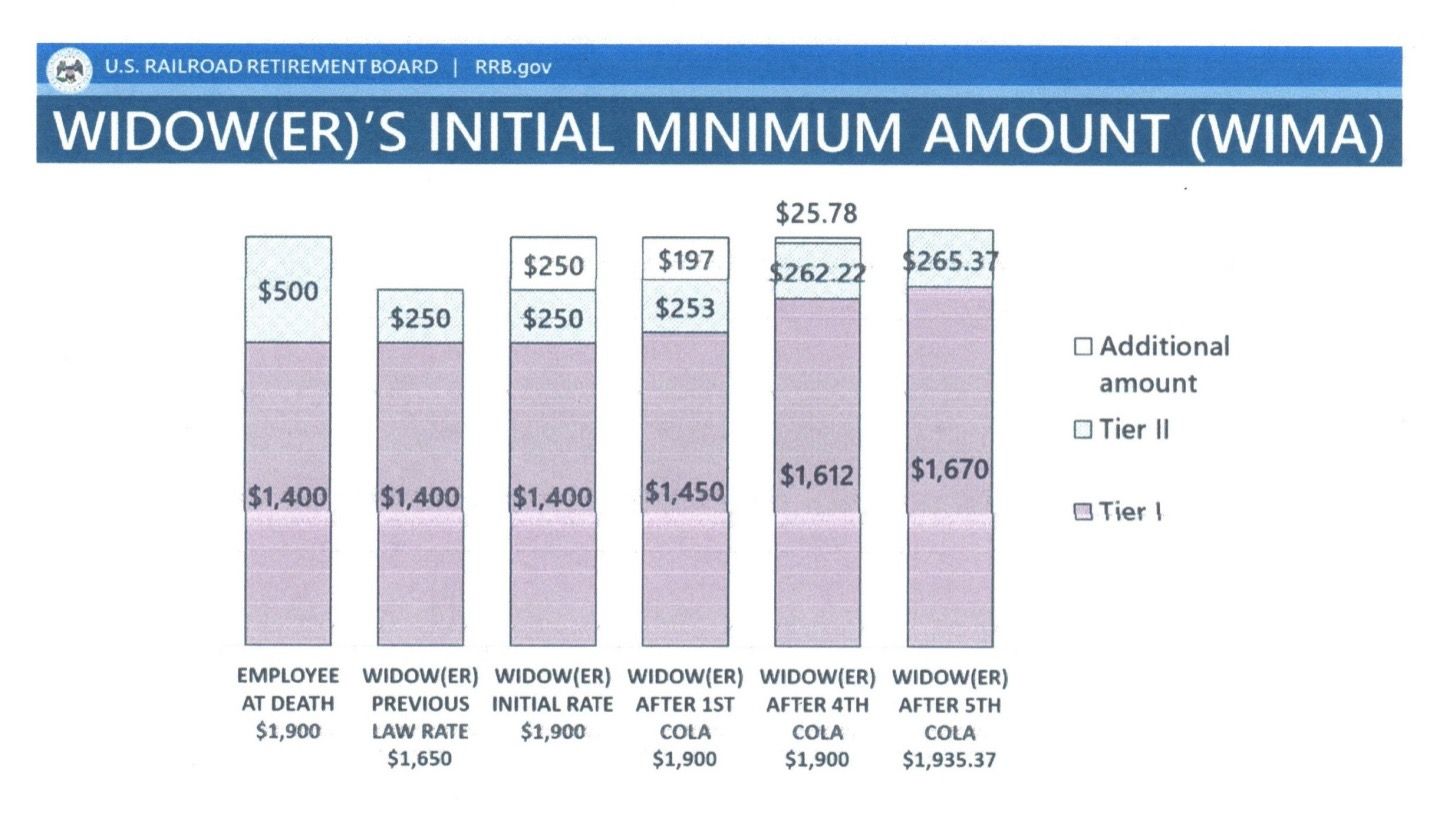

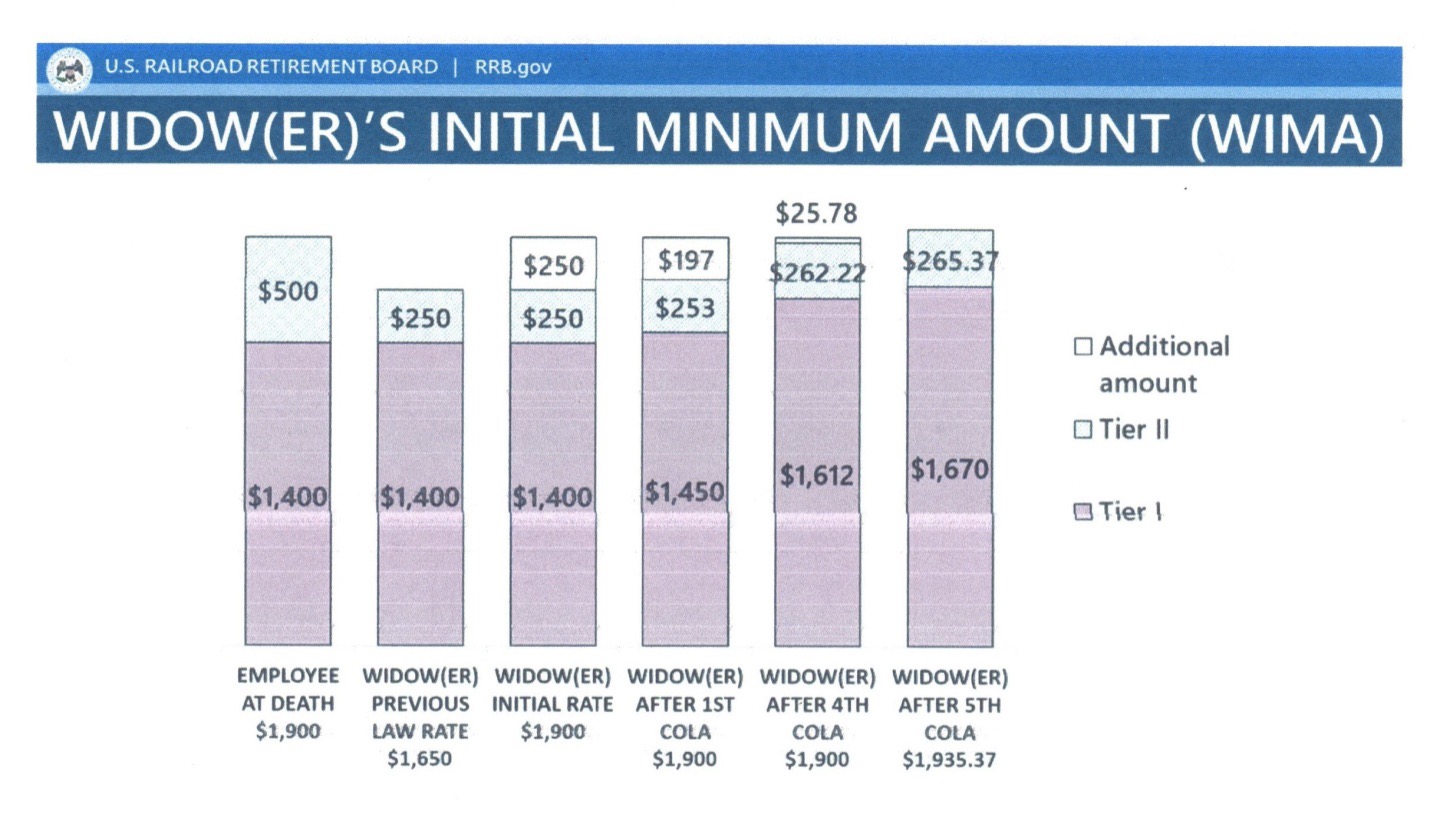

The RRB provides the below example to demonstrate how the WIMA applies.

In this example, at the time of his death, the employee was entitled to $1900 and under the pre-WIMA law, the widow(er) would have been entitled to only $1,650. But with WIMA applied, the widow(er)’s annuity is increased by $250 in her first year of entitlement, so the widow(er) receives $1,900. As a result of the WIMA provision, the RRB paid the widow(er) $250 more a month in the first year than what would have been paid prior to WIMA – or a total of $3000 more in the first year of entitlement. During the five years in this example, the widow(er) would receive $8,400 more than what was payable under the previous law. In the sixth year, the widow(er)’s entitlement under the previous law, with COLAs applied, is $1,935.37, which exceeds the $1,900 WIMA amount, so COLAs are applied and will be applied in all future years.

Railroad Retirement benefits are individually calculated and are based on many factors that are unique to each individual For example, widow(er) benefits are reduced if the widow(er) has not reached full retirement age on the date the survivor annuity begins. Full retirement age is defined as age 65 for individuals born before January 2, 1940 and age 67 for individuals born 1960 and beyond. For individuals born between 1940 and 1960, full retirement age gradually increases from 65 and 2 months to 66 and 10 months.

Click on this https://www.rrb.gov/OurAgency/LaborMember/Pre-RetirementSeminars/videos or go to the RRB website to see a RRB presentation on survivor benefits. If you have question about your benefits, call the RRB at 877-772-5772.